Short Term Capital

What is a Short-Term Working Capital Loan?

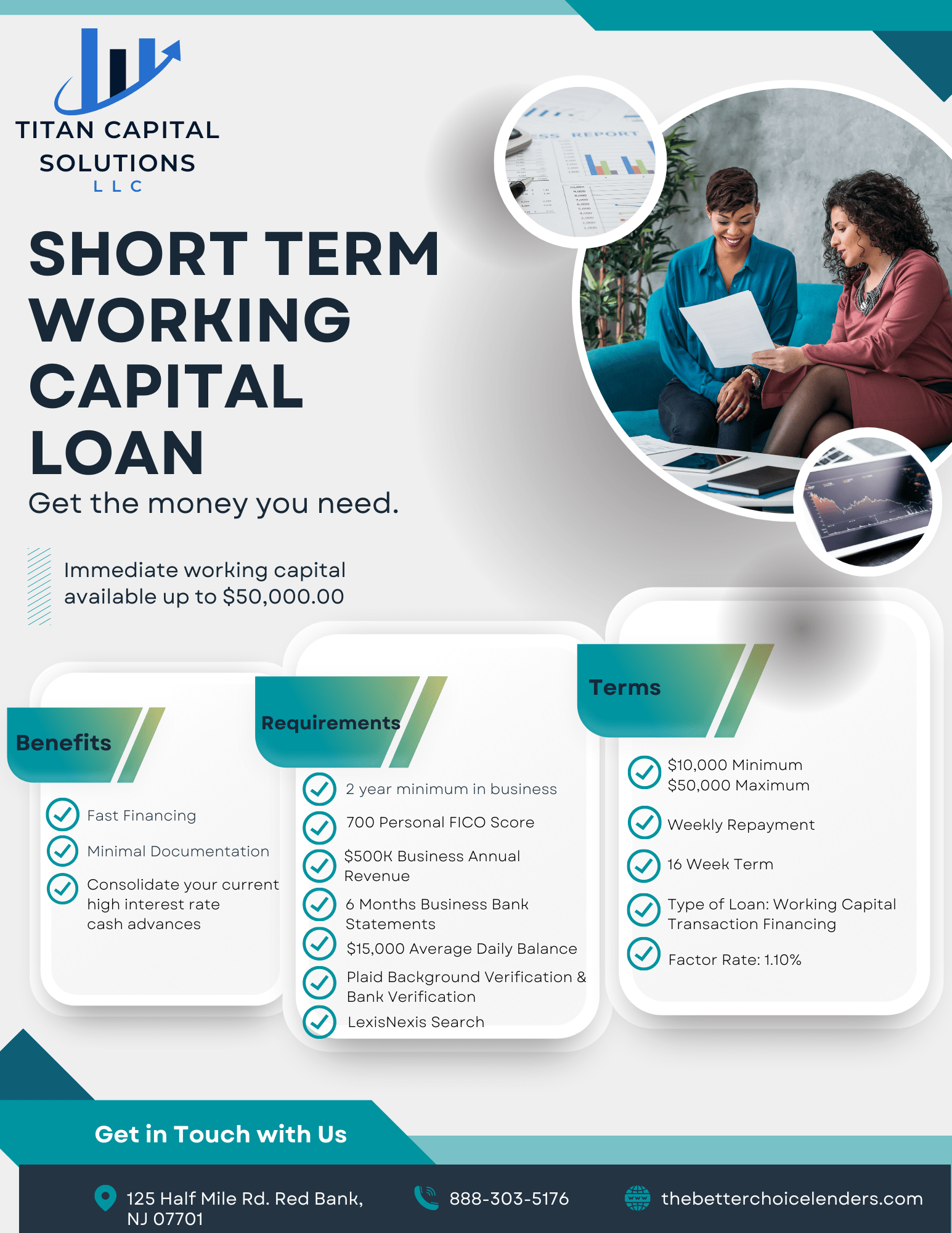

A Short Term Working Capital Loan gives businesses access to capital fast to meet their business needs based on future credit card receivables. The way this business cash advance works is it provides the business access to funds in a fast and simple way in return for a portion of the business’s future revenue receivables at a discounted price. To be approved for an WCL, certain criteria must be met. An important criterion, among others, is that the business must accept credit card payments or have other receivables.

Our Working Capital Loan amount starts at $10,000 and ranges up to $50,000. This business advance is ideal for businesses that need fast access to capital funds with a simple and easier application process. The merchant cash advance also provides the business with flexibility as the advance has variable payments based on business receivables. If your business has high credit card sales, has lots of receivables, or is seasonal, then a merchant cash advance might be ideal for the business.

Flexible Payments

Automatic payments are calculated based on a percentage of the business’s credit card sales or other receivables.

Completion Date

Payments are based on the business’ receivables so there is no fixed payment term

Cost and Fees

The receivables are purchased at a discounted price and fees may be charged and deducted from the advance amount

An estimated completion date is calculated based on the estimated time it will take the business to deliver the receivables (which will vary based on the business’ performance). These estimated completion dates typically range between 3 months to 18 months, but this is only an estimate.

The BTCL Working Capital Loan allows fast access to capital.

Quick facts

- $10,000 minimum – $50,000 maximum

- Weekly Repayment

- 16 Week Term (4 months)

- Type of Loan: Working Capital Transaction Financing

- Factor Rate- 1.10%